Investing In Your 20s And 30s: Millennials Think Differently

![]() Investing In Your 20s And 30s: Millennials Think Differently

Investing In Your 20s And 30s: Millennials Think Differently

Millennials are often criticized in the press for putting off financial planning and being too risk-averse. According to a 2014 survey, millennials devote less than one-third (28%) of their portfolio to stocks and over half (52%) to cash, while non-millennials keep almost half of their portfolio (46%) in stocks and less than a quarter (23%) in cash.1

If you fit this picture, there may be a good reason you’ve put off saving and investing. For one, you’ve just witnessed the effects the Great Recession had on your parents. Or, like millions of other college grads, you may have thousands of dollars in student loans due. Saving may not be a priority.

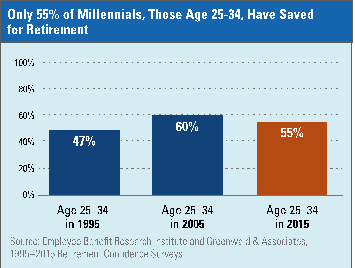

Staying out of the retirement savings arena is a decision that could significantly affect your quality of life down the road. Notwithstanding the economic recovery that began in earnest in 2009, 32% of 18- to 30-year-olds said they haven’t started investing in their retirement because they don’t know enough. And fully 42% claimed they didn’t have enough money to invest.2 A recent Wells Fargo study showed that most millennials put half their income toward paying off debt, with a roughly equal number claiming that they live paycheck to paycheck.

Head or heart: How do you make decisions?

While the baby boomer generation grew up digesting streams of logic-based data and print media, the way that millennials absorb information and communicate is considerably different. According to Stanford Professor BJ Fogg4, you may be wired to respond better to short, digestible videos on investing topics, directed one-task workshops, and more motivational approaches designed to inspire taking action.

No matter your age, when investing, emotion plays a more important role than you may recognize. Some of our earliest memories of money inform our lifelong relationship with it. If you’ve talked to anyone who lived through the Great Depression, which completely destroyed 9 million savings accounts in three years5, you will understand how risk-averse this group has been from a young age.

While there are parallels between the Great Depression and Great Recession, you are likely to have very different response mechanisms to up and down markets than your parents or grandparents. Having grown up with social media, you probably have a support network in place. This helps to know you are not alone. But there are also innovative sources of retirement advice available online or that exist in less formal settings and are designed to be more relevant to the digital generation.

For example, some financial advisors and digital communications firms, such as the Society for Grownups, put on small, in-person “salons” on subjects outside of financial planning and tie them into financial planning, such as investing and fine wine, dinners, classes and coffee dates. You can be sure that whatever appeals to your personality and interests, there’s probably a group out there talking about it—and making investing part of the conversation.

Wherever you connect financially as a millennial, it’s important to find a more relaxed way of talking about retirement—one that instills confidence to take action. Rather than formalized financial education that you might get at a work meeting, you may enjoy interacting with others who are in a similar life stage, willing to share their knowledge of saving and investing.

While no two investors are alike, fortunately, there are resources that can help in making complex decisions—like how much to save—easier.

2 Source: bankrate.com

3 Http://money.usnews.com/money/personal-finance/articles/2014/06/18/why-millennials-still-dont-save-enough

4 “Baby Steps,” NAPAnet Magazine, June 2015

5 H. Goodson, Coursework: “Handout 10: The Great Depression,”

http://www.westga.edu/~hgoodson/The%20Great%20Depression.htm

Disclosure: This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. LPL Financial and its advisors are providing educational services only and are not able to provide participants with investment advice specific to their particular needs. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.